There is a growing and numbing realisation of just how bad Sunak’s budget really was. Worse, he’s even now saying that there is nothing he can do about poverty. This is thread to explain why he’s failing and what we can do about it if we want to change our politics.

If you want a summary of the whole thread it’s this: the neoliberal thinking that all our main political parties subscribe to is now bankrupt. We need something new now.

Sunak faced a challenge on 23 March 2022. A winning Chancellor has to decide how to secure the support their party needs to win elections. In that case there will always be winners and losers in a budget. So Sunak had to make decisions.

However, it’s fair to say that decisions are always constrained. No budget has, I suspect, ever delivered precisely the policies any Chancellor has really wanted. That’s because all politicians are fantasists and reality has to be addressed as well in any budget.

The overwhelming realities that Sunak needed to address were really not hard to spot. First, there was the real economic chaos created by shortages in the economy. These are the result of Covid, Brexit and now war, but which heavily pre-dated the last of these factors.

To be blunt, oil and gas as well as many foodstuffs, from wheat to sunflower based products, to fertiliser, have been and will be in short supply. And with China in an uncertain political and economic space the possibility of further supply chain disruption from there is high.

After forty years of domination of the world economy, the theory and practice of globalisation is failing. Covid showed it could not cope with crises.

Worse, Russia has very obviously opted out now. And it’s now clear that China engages on its own terms, and views trade as a mechanism of control, not liberation. The ‘one-world, one inter-linked economy’ idea underpinning globalisation is now history.

Sunak has not noticed. In the Office for Budget Responsibility report on the economy published this week every chart shows they think we are suffering a short-term blip at this moment and everything will go back to normal very soon. I have news for them and Sunak. It won’t.

Even if war in Ukraine ends soon, and even if Russia is defeated, as at least seems possible, nothing will go back to ‘normal’, just as nothing went back to normal after the 2008 global financial crisis.

Life is lived forwards, not backwards. Sunak’s philosophy says otherwise. It’s wrong. By its nature, Conservatism seeks what was, and not what might be. That was very clear in the budget documents. The implicit appeal in them all was to just let things be normal. They aren’t.

In that case, not only is globalisation dead, but so too is the political approach that supported it. The neoliberal philosophy that has dominated politics since the late 1970s is based on the logic that there is just one way of doing economics, and you can’t buck it.

What we now can very clearly see is that the ideas in neoliberalism are wrong, and that there must be a better way to do economics.

That brings me to the second reality that challenged Sunak’s fantasies yesterday. This is inflation induced poverty. The sudden onset of inflation is not like anything we have faced before. In that sense the comparison Rachel Reeves made between Sunak and Ted Heath was wrong.

The 1970s inflation was caused by three things. One was coming off the gold standard, with no one understanding the consequences. The second was union power pushing wage rises to match price rises.

The third was the politically driven increase in oil prices, linked to conflict in the Middle East. Put together they were a toxic mix, but one which took some time to develop. We had several years of inflation before it reached its peak.

The current inflation is nothing like the 70s. It has had a sudden onset, leaving us wholly unprepared for it. And the driver this time is the market power of those who can exploit uncertainties and shortages in the world economy for their own political gain.

Oil, gas and food are being traded at enormous profit across the world right now, at cost to us all. As if to compound the issue, central bankers are getting in on the act by pushing up the price of money in an attempt to create a shortage of that as well.

If the source of power that fuelled 1970s inflation was trade unions, then the source of power that is now holding the world to ransom is unfettered control of markets by a relatively small number of companies and traders who are exploiting shortages for gain.

It does not matter whether the exploitation is by the producer of the product, its shipper (and shipping prices for gas are sky-high), traders in the commodities markets, or distributors: shortages have turned their companies into cash machines, as BP’s boss has put it.

If there is a power structure behind the current inflation it is the concentrated, unaccountable market power globalisation has created that is now turning upon the people it was meant to serve.

Sunak did nothing to address this in his statement. There was no windfall tax. Indeed, his promise was of business-friendly tax reforms to come. Instead of naming the beast he faces, Sunak sought to accommodate and even facilitate it. Reality passed Sunak by.

The third reality that Sunak had to face was the hardship that this exploitation is creating. The ONS says that real household disposable income will fall by 2% this year. They are wrong. Their inflation estimate is too low.

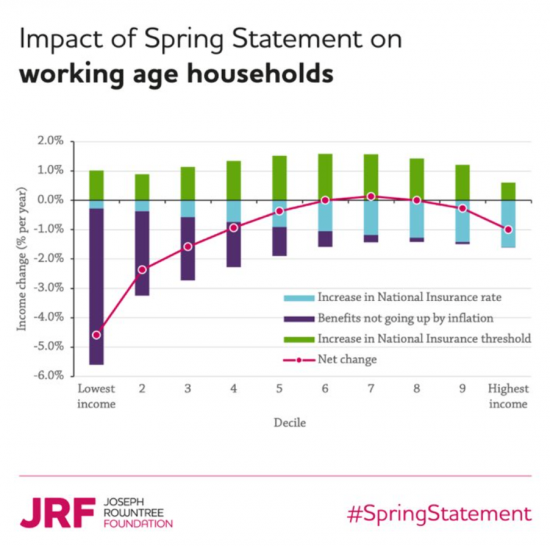

The Jospeh Rowntree Foundation think that the impact of the budget measures looks like this, and it is apparent that it is the worst off who are hit hardest, but remember this is just the budget impact and the impact of inflation is bigger than that:

The ONS do not also allow for the fact some are gaining when they calculate their average. I am not saying my own estimates are right. No estimate is. But I think for 30% of households the cost of living could rise by well over 10%. Even the best-off 10% might be 5% down.

I think I am closer to the truth than the ONS. The belief is widespread that millions are going to face poverty because Sunak did not act this week.

He did not raise pensions or benefits. He did impose the NIC increase, and a confusing simultaneous cut. He cut fuel duty by a meaningless 5p. He gave £500 million to a hardship fund. He also gave £2.2 billion to bailing out Bulb, the energy company. And he hammered graduates.

As an exercise in indifference this was staggering. I would call it callous. Of course people are crying on phone-ins. They literally have no clue what to do. And candidly, I am clueless as to what to tell them. They have been cast adrift by a government that does not care.

These were, then, the three realities that Sunak had to face. They are that neoliberal globalisation is dead; that exploitative capitalism is driving inflation, and that the result is that many millions face crushing poverty. He failed to spot any of those realities.

Worse, the Office for Budget Responsibility, and so most of the media, have not noticed the second-order consequences of all this. The OBR thinks things we will go back to normal. I know they won’t. And I have good reason for that.

The simple fact is that people who cannot afford their rent, mortgage, heat and food (the bottom order priorities in Maslow’s hierarchy of needs) will not be spending on anything else. And so leisure, travel and holidays go by the board. So do fripperies like new clothes.

And when people stop spending on things like this then businesses fail, people lose their jobs and the crisis of deliberately imposed poverty will get very, very much worse than it is now.

There will be massive rent, mortgage and fuel bill defaults. There will be mass evictions from homes unless people are protected. And there will be personal debt crises that could easily spill into a banking crisis.

We are not in that case heading back to normal as the Office for Budget Responsibility think. We are heading for recession, at best. It could be worse than that.

Neoliberalism has no answers to this crisis. That’s because neoliberalism’s political answer to all questions is to say politicians should stand back and let the market find a solution.

That’s what Sunak is doing, of course. His indifference is not chance. What he’s done is a little posturing but he is then saying let what the markets decide be. If the market wants poverty, so be it, he is suggesting. That, he thinks, is the way it must happen.

But, of course, the crisis we face is the result of using that approach for decades. This is not a crisis to be cured by neoliberalism. This is a crisis caused by it. The poverty we are seeing was created by the rigged markets and power inequalities neoliberalism delivers.

And neoliberalism cannot solve the crisis it has now delivered because it has but one tool in its armoury, which is to let the market decide. But, we now know if we did not before now, that the market can make very bad decisions. In that case, the day of neoliberalism is done.

Let’s be clear though that socialism is not the alternative to neoliberalism. Neoliberalism is a dogmatic form of politics based on assumptions unrelated to any known form of real-life human behaviour. Socialism shares all those faults. So, let’s dismiss it as an option now.

If there is to be an answer to the crisis that we face – and there has to be if we are to go on and face the bigger one that climate change poses – then the answer has to be pragmatic and value-driven in contrast to the dogma that has delivered us into crisis.

To be precise, the compromises that drive liberal democracy have to prevail. Each person has to count. Their views have to be heard. The government must be accountable to all, not some. The purpose of policy must be to create the compromises that achieve that.

The excesses that markets are prone to have to be curtailed, but the fact that people wish to trade has to be recognised. And those who trade must recognise that they need the regulation that government supplies if there is to be the level playing field fair competition requires.

Taxes must be fair. They must be paid. There must be transparency about this. There must be investment in the tax system to make this work, so all can see it.

Government must understand its role in the economy, most especially as a money creator, which it must be. The idea that it is just another business that must balance its books is crass when the whole economy is dependent on the money it creates, controls and lets us use.

The whole idea that there is no such thing as government money has to be thrown away then. There is in fact only government created money. Look in your wallet or purse, or bank statement. There are pounds there. And pounds are government created money.

The idea that there is no money for the government to solve a problem like poverty is not true. The government can always create the money needed to solve such problems. What it actually has to do is make solving that problem its priority over other uses of money in the economy.

Thankfully the government has a tool that lets it reallocate resources in this way to tackle the problems that we face. That tool is called tax – which is a term that extends to benefits, which are negative taxes in all but name.

In that case the government and all politicians need to realise they are not neutral parties that are required to stand back from the action as neoliberalism dictates. Instead, they have the power to direct and change the economy and should use it. What else is politics about?

In particular, it is the job of government to address the imbalances neoliberalism has created, most especially when neoliberalism has the goal of increasing wealth for a few at cost to the many.

This policy of inequality creation has now reached the inevitable point where it results in mass poverty. To address this not only must that income inequality be addressed, but so too must the wealth inequality that has driven that income inequality be tackled as well.

In particular, the idea that government must leave wealth and business with as low taxes as possible whilst loading those in work with the unaffordable burden of supposedly paying for public services that fail to meet need as a result must end.

So too must the idea that only people can spend money wisely end.

As must the idea that money given to the public sector is poured into a bottomless pit go for good. If the crisis facing the NHS does not convince reasonable people of that, nothing will.

Instead, we need a new culture for a new politics. The need for that culture is laid out before us now that Sunak has created a poverty crisis, by choice. That new culture must be based upon meeting the needs of all, whilst allowing as many as possible to satisfy wants as well.

Right now it is apparent that as a society we are failing to meet basic human needs:

Food is going to be beyond reach for some. Covid has proved we cannot deliver safe air to people. Water bills will be impossible for many. As will shelter be. And with the poverty we’re facing go all the issues around security, including of employment.

Talk of growth, wealth, government book balancing or debt are just offensive in the face of these realities. That is what a new politics has to recognise. The ideas in Sunak’s budget that allowed these things to take priority and offered nothing to public services are wrong.

So too are dogmatically driven tax cuts and tax reforms to make the life of business easier offensive when there are communities in this country who cannot afford to meet their basic needs. That is politics from which all morality has been removed.

Sunak has chosen to serve the interests of a small, wealthy, part of society and abandon most people, because he believes (and he has said this) government cannot address all problems, and he apparently includes poverty in that category. What is the state for then?

The economics of a new politics – and the two are always related since all politics is eventually about who gets to partake in what share of the resources of society – has in that case to be built around the idea that meeting need is the absolute fundamental task of government.

There are other concerns for government as well. It must, after need is met, deliver education and ensure people are defended from risk. It has to uphold law, fairly. And it has to do all it can to ensure that a society is sustainable, or it has no future. But need comes first.

It’s as pointless to say that government cannot afford to ensure needs are met as it is for government to claim it cannot afford to tackle climate change. Saying either presumes that the protection of wellbeing is not what government is about, when that’s the core of its purpose.

Unless the protection of the weakest in a society, and the protection of that society itself is what government is about then it has no reason to exist and no moral authority to act. It’s as simple as that.

In that case the government has to marshal the resources of society to achieve these goals. What are those resources? They are its people, the physical resources the state can command (subject to sustainability) and both the financial income and wealth within it.

What government can do is threefold. It can encourage people to use their talents and resources in ways that contribute to the common good. We used to call this industrial policy.

This industrial policy must be delivered through the use of regulation and the tax system to encourage some actions in preference to others. Sometimes that is by the government choosing to make the supply itself e.g. through the NHS and state education.

Other times it is about influencing what business does through the use of tax and regulation to encourage and persuade so that some actions happen, and, if necessary, on other occasions to ban an activity, or to only allow it under licence.

The government should decide what it wants and do it. So, if green energy is required its job is not to deliver a speech. It must instead intervene directly to deliver that policy, by building such systems, if necessary; by banning carbon over time; or by taxing it out of use.

This is the exact opposite of neoliberalism. There is no pretence here of letting the market get on with things. We know markets will never go green by choice: exploiting carbon is easy and that is what markets would do until life on earth ended. Action is required then.

That’s only the first step though, however important it is. The second step is to use the financial wealth of a country in the common intertest, whilst still respecting the right to private property.

There is a bargain here. The right to property is not absolute. It’s conditional, and created by law. Unless violence proves entitlement to claims on asset that has to be the case because in a liberal democracy it is law that defines property and defends a person’s right to it.

The bargain is that if law creates and defends this right to property then the right to ownership is dependent upon the conditions attached to owning it, including publicly acknowledging ownership, using property responsibly and paying the taxes due as a result of doing so.

In other words, the relationship between the state and private property is not as neoliberals like to represent it when they say that property is private and the state steals it through taxation. Rather it is a bargain based on proper use.

That bargain is that the owner is permitted use and protection of the property if they have been compliant with the conditions for doing so.

If in any doubt about this, note that this is the logic used in Russian sanctions regimes. Oligarchs are deemed not to have complied with the conditions for the ownership and use of their property. As such they have been denied the use of it.

That is an extreme example, but proves a point: all property rights are actually built around this conditionality e.g. we can own and drive a car so long as we insure it, MOT it and drive it appropriately with a licence to do so. What I am saying is what is normal, and accepted.

Importantly, the property within the scope of this review if of two sorts. The first is income. The second is capital – what we call wealth. For reasons that are incomprehensible neoliberal government only concentrates on the first.

So, almost all taxes are based on income or transactions derived from income, such as sales taxes. And the government itself is not managed around wealth – indeed the concept of asset management is almost unknown with the Treasury of most countries.

It is as if the whole system of neoliberal government, its system of finances and its management of resources wants to turn a blind eye to wealth so that the system of wealth accumulation that is the goal of neoliberalism goes on without attention being given to it.

As example, inflation is defined around income and must be minimised. As a result wages are suppressed, even whilst they are the basis for most taxes. On the other hand, asset wealth – whether stock markets or physical property markets – are celebrated when they inflate values.

What is more, that property value inflation is very lightly taxed, if at all.

Meanwhile, the government balances its books without reference to a balance sheet that takes into account the value of the assets it owns or the investments it makes, which is bizarre.

It’s as if all politicians assume that society, whether households or individuals, pays for all its asset investment e.g. in buildings and equipment, out of its income and never takes a loan to finance this activity, because that’s what they seem to think governments should do.

This cannot continue if society is to tackle the issues that it now faces. To ensure government uses all the financial resources within society it not only has to tax capital fairly, but also use that capital to fund the investment now needed, including to deliver sustainability.

With regard to taxing capital fairly the capacity is enormous. Looking at data for the period 2011 to 2018 I have shown that if increases in the value of people’s capital had been taxed at the same rate as income from work then £174bn of extra tax a year could have been raised.

This may not be optimal, but it shows that when it is claimed there is no tax revenue available to the government that is the result of a choice on its part to not tax wealth and not because that claim is true.

With regard to wealth, there was in March 2020 (the most recent date for which there is data) £8.4 billion of financial wealth in the UK, of which 82% was in pensions and ISAs, which are heavily tax influenced investment vehicles, the use of which the government can regulate.

Large parts of these funds are invested in fixed interest bonds – whether issued by the government or companies. Those government bonds form part of the national debt. And yet the rhetoric of politicians is that this borrowing is unwelcome and must be eliminated.

It is important to stress that savings and borrowing are, of course, the flip side of each other, and that the so called ‘national debt’ (which includes everything from the notes in your wallet or purse, to Premium Bonds, to government bonds) is just savings of various sorts.

The idea that people’s savings, voluntarily placed with the government because they provide the most secure place available to anyone for their savings, is ludicrous. Instead, savings of this sort should be encouraged. People’s private capital should be used for the public good.

If there is a single change at the core of this new political philosophy that I am suggesting it is this – that the taxation and use of private capital is at the core of the provision of public services for the benefit of all, and that paying people a fair return for using it is just fine too.

It is important to explain the economic logic of this. The money from borrowing is used to take expenditure out of current government budgets. Most years the government spends at least £50bn on capital investment in things like schools, hospitals, roads and so on.

These should not be treated for government accounting purposes as if they are the same as expenditure on, for example, pensions, paying teachers, and prescribing drugs. In accounting terms, they are not. They are capital spending and the others are revenue costs.

Treating them as capital expenditure and raising appropriate finance to pay for them is a totally normal thing to do. It is what business does, day in and day out. To stress the point, nothing that I am suggesting here is in any way radical or unusual. It’s just good practice.

However, the immediate consequence of doing this is to change the whole profile of government accounting. I suggest expenditure on these capital assets be charged to the government’s balance sheet, and from there be expensed over what might be quite long periods of time.

There are, however, other immediate benefits, apart from reducing the apparent deficit by this amount of this expenditure, now treated as being on assets, which in the process eliminate the argument that we cannot afford to tackle poverty.

In particular, the expense of producing these assets might go to the balance sheet but the taxes that are paid by those who are engaged in making them are quite appropriately treated as government income in its income account. That tax paid is, then, a boost to government funds.

Accounting in this way reflects the reality of what is happening. The government investing using people’s savings create new wealth that results in new income, which then boost government tax revenue, and helps its argument that it can afford to tackle poverty.

And this is no con trick: this is what actually happens when private capital is put to public use for the benefit of all in society. We all win because that money has now produced a benefit not just by producing the asset, but by allowing for its use in the long term.

What might those benefits look like? Presuming the money is wisely spent – and this is down to electing good politicians – the outcome will be that we have a better resourced country, and more available to spend on public services as well.

If we turned some more of that £8.4 trillion of private wealth in the UK to public advantage we could, for example, have more social housing with high insulation and fair rents, for a start – with land bought without paying a premium for development value.

And we could transform public transport – to make it more accessible for all when right now travel is a privilege and not a right.

Then we could transform energy generation – under public ownership so that we can never be held to ransom again. That would help address the problem of inflation.

We could also invest to save energy which is vital if we are to be sustainable. It also happens to create very large numbers of secure jobs for a long time to come. And we need to do this in the public and not the private sector to keep the cowboys out.

After that we could also invest in sustainable rather than intensive farming to increase food security. The list goes on, and on. And because this could be done without cutting into current spending budgets we’d also have more better paid jobs and more money for services too.

But what happens in this case if private investors do not wish to save with the government? First, interest rates could be raised if necessary. That should secure more funds. Alternatively, quantitative easing can be used to fund investment instead.

Relatively few people understand QE, and it is a technical issue. But, what in effect happens when QE is used is that the government creates new money which it uses to make the payments due for public services instead of using borrowed money to do so.

There is a paranoia fed by neoliberal politicians about government money creation. It is misplaced. If you think you really do not like government created money, please feel free to send me all the notes and coins that you have because they are all part of the national debt.

How does the government create this money? The process is very simple. In practice all that the government does is to make a promise to pay. Again, if you are in doubt, look at the money in your pocket. That promise is printed on every bank note.

What the government does, in practice, is to promise to pay the Bank of England back money it lends it. In exchange the Bank of England promises to pay whoever the government tells it to make payment to. And that exchange of promises is how the government creates new money.

I stress, again, that there is nothing odd about this process. It is exactly the same process that is used whenever a bank makes a loan to a customer. The customer promises to repay the bank the loan. The bank then pays it to whoever the customer asks them to make payment to.

No other customer’s money is involved. It is just an arrangement between you and the bank. All money is made in the way. However it takes a bank registered by a government to let this happen – because only they can access the bank payment arrangements.

The Bank of England is just a rather special bank, that’s all. That’s because it’s the government’s own bank, and ultimately it makes all the money that we use, or regulates the commercial banks that can also create money by lending.

Neoliberal politicians have refused to acknowledge this truth because in principle it means that their argument that they can’t do something because the money is just not available is never true. In practice the government can always create money for whatever is needed.

If you are in doubt about that the entire £400 billion cost of the Covid crisis was paid for using money created using the quantitative easing process. None was paid for using debt and none was paid for with taxes.

This also makes the argument that we have to now repay this money used to pay for Covid quite absurd: there is no one to repay it to. It was created for the government by the bank the government owns and paid into the economy where it was used to keep the economy going.

And the one thing we do known for certain is that it did not create the inflation we must tackle now. That, as I have already explained, was created by oil, gas food and other companies and traders exploiting shortages of essential commodities within the economy.

So why mention quantitative easing? Because what it provides is a guarantee that the government can always repay its debts, come what may, whenever and if ever they are demanded of it. The Bank of England can always create the money required to make payment.

What that means is that saving with the government is the safest thing anyone can ever do. Every other person you lend to might default. The government in a country like the UK with its own central bank, own currency and which only borrows in its own currency cannot do so.

And what that means is three things. First, it’s always safe to save with the government because, second, they can always repay and, third, the government can offer a low interest rate as a result because there is no risk at all of not being repaid.

But add all that up and the government should be the place where people want to put their money to make sure it is both safe and used for public benefit. Not all their money, of course, but some, quite probably.

And if that were done private money, saved with the government, could be used to transform our society. So, what a new politics of transformation has to do is recognise these facts (for facts they are) and liberate money to achieve this goal for the benefit of society at large.

So, to conclude. We’ve a crisis created by markets that neoliberal economics promotes. It is markets that are driving people into poverty by creating inflation that the government will not tackle, just as it won’t tackle the resulting poverty. So, neoliberal politics has failed.

In that case if we care about poverty we have to abandon neoliberal economics – with all the assumed but unreal constraints that it imposes on governments – that the Tories, Labour, LibDems and SNP have all subscribed to in the UK over the last forty years.

I stress, the Tories may have been the most neoliberal political party in the UK, but even Labour under Jeremey Corbyn talked about the government having a maxed-out credit card and the fact that they could not create money to solve problems when that was not true.

We cannot create a society that will tackle poverty, meet need, create jobs for all, provide economic stability, break our dependence on oil, gas and imported foods and also deliver sustainability using the existing politics or economics in that case.

When all our political parties are wedded to a politics that says these things are not possible because they refuse to understand how money works, how savings and government borrowing work, and how both can be liberated for the common good, we have to reject them.

We also have to reject politics that refuses to accept that rising inequality is what has led us to this current crisis where millions will be in absolute poverty, which they have tolerated and encouraged by failing to deliver proper taxes on wealth to support those in work.

It is time for a new politics. A politics committed to meeting need, to creating a more equal society, and a sustainable one too. And one that puts private wealth – like pension funds and ISAs – to work for public benefit in a way that no politics to date has agreed to do.

Is that possible? I know that what I’ve described in terms of accounting and economics is all correct. None of it is radical. In fact, its commonplace in the commercial world, whilst the way I describe money is just how things actually work, as the Bank of England agrees.

So what is stopping us having the society we want and need? What is stopping us ending poverty? And what is stopping us being sustainable? Only the stranglehold of political parties dedicated to the old order – that stops us having all these things – is doing that.

How do we overcome their objections? We either change them from within, or we have to change them from without. But they, and their combined dedication to keeping neoliberalism in power, are the biggest threat that we face.

If we believe our current politicians we will balance the government’s budget but at the same time let people starve, see the elderly die of cold and watch our planet fail because they say we cannot afford the risk to create the money required to save people and life on earth.

If that’s what you want, stick with the politics we have and the politicians from all main parties, without exception, who all subscribe to the belief that the money needed to change our worlds is not available, in a country where there’s financial wealth of £8.4 trillion.

Alternatively, we have to dismiss that collective nonsense and say money is the servant that should make the world a better place – which is possible, without in any way creating a revolution, or creating some sort of socialist utopia – which I want no more than you do.

I just want to put sound money, sound economics of what really happens in the world, some proper accounting, and some clear management tools to work to build a better world based on the principle that each of us has the right to be here and to have a good life.

A life that is, free from fear, and with the hope that generations to come have the chance of that as well. It might not seem a big ask, but it is being denied to us by those who promote a mantra that prevents financial wealth being used for the benefit of society right now.

That has to change. I’ve said how that can be done. But others have to deliver. No one person can do everything. All I can do is say that there is a way out of this mess, this crisis and this poverty that now faces us. But it takes those with the political will to turn that into reality.