Danny Blanchflower had a longish discussion pn August 17 in which we agreed that the inflation that is dominating economic discussion about our economy at present is a passing phase. That does not mean it is not important. Far from it, in fact. But what it does mean is that when discussing inflation we have to remember that this is a temporary phenomenon, and what is just as important is to discuss what happens after it.

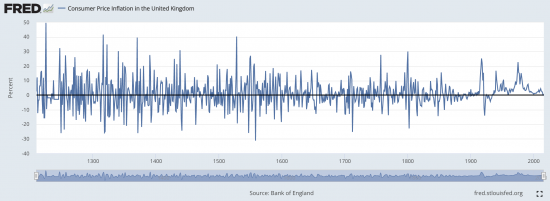

There is a lot of evidence to support this opinion. First, take this St Louis Fed chart which summarises data from the Bank of England on inflation trends in first England and then the Uk over a period of more than 800 years:

After a period of inflation there has, historically, been deflation, and even if the latter has been rare of late, there is always a return to more normal rates. Inflation does not persist.

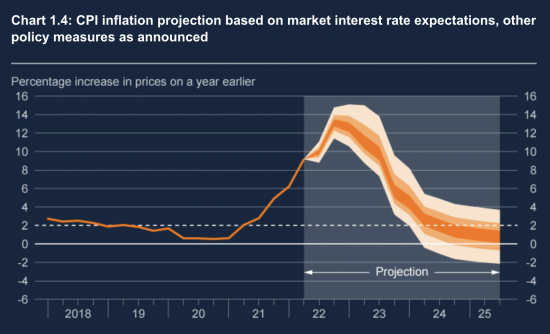

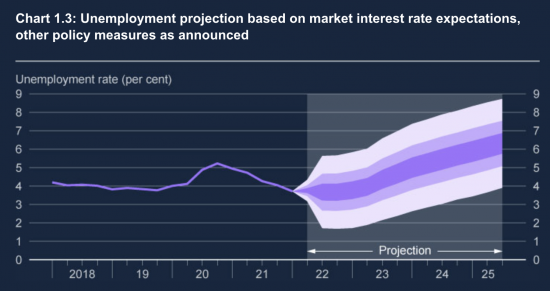

The Bank of England agrees right now. The data is from the August Monetary Policy Committee forecasts. They say we might have zero inflation and even have a risk of deflation by 2024:

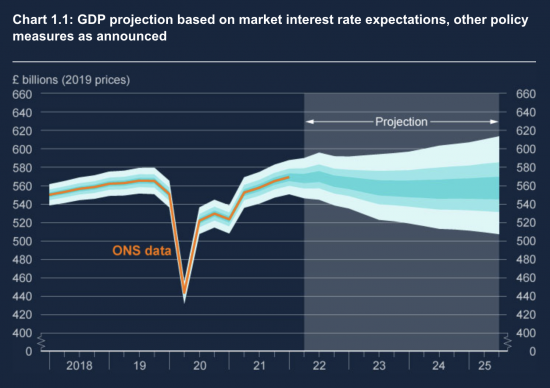

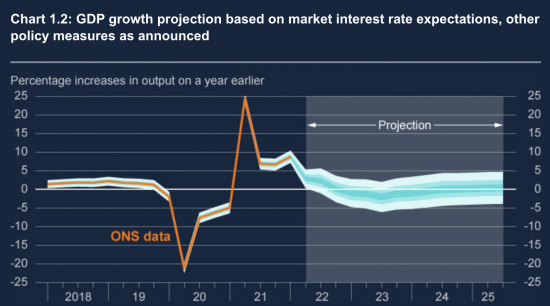

Why is that? Because they think their plan to crash the economy will work:

They think they will achieve that by pushing unemployment significantly higher. There are victims, in other words:

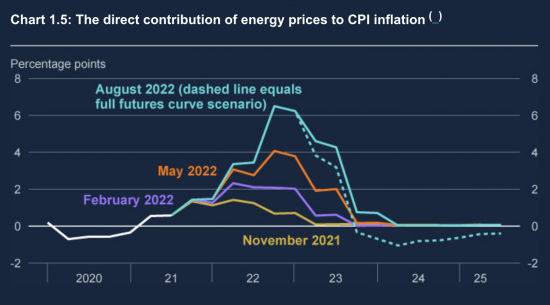

But let’s be clear that their forecast of falling inflation is not based on their either crushing the economy or employment: it is based on falling fuel costs:

This is the determining factor.

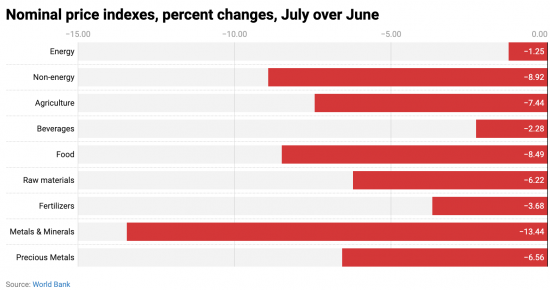

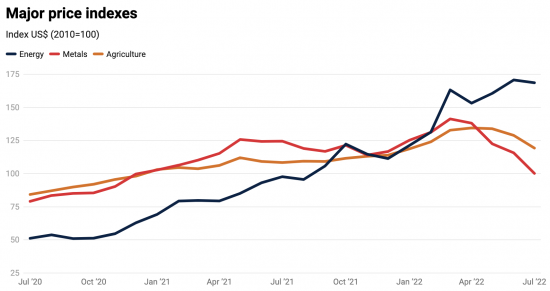

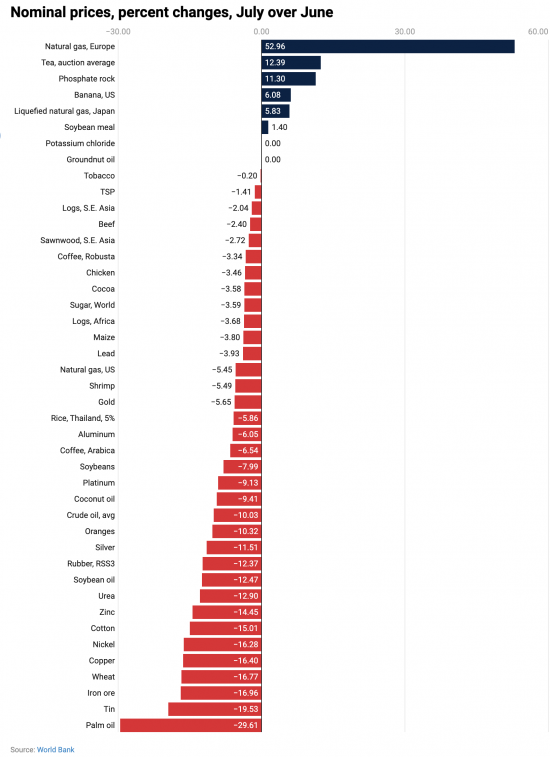

There is real-world evidence to suggest that prices, excluding gas in Europe are now actually falling, and fast. This data comes from the World Bank, earlier this month:

Energy in Europe remains aberrational and the UK is an outlier in its dependence upon gas, 50% of which we have to import now. The price of tea is not good either. But, thereafter commodity prices are falling, and whilst the impact of that is not being seen in shop prices as yet, because the impact of energy cost increases is overwhelming them in Europe right now, this is bound to work through the system and prices will, like night does day, begin to stop rising, and in some cases will fall.

The significance of this is threefold because what it says is that we have a crisis that is going to have different stages requiring different responses, but all of them must be anticipated now or the situation will get very much worse.

The stage we are in, which is going to get worse in the short term, is the inflationary stage because of the impact of gas prices. It will be temporary. This is the vital thing to appreciate. It is very likely that, as the Bank of England forecasts, energy prices will fall and cease to contribute to inflation, and maybe quite quickly. Even the behaviour of the energy companies that are seeking price caps lower than those that Ofgem suggests that they are aware that this is not only the case, but that increasing prices now will be deeply detrimental to well-being and are seeking to avoid those price increases happening as a result.

The policy response in this stage is survival. At this stage, the shock to people, businesses, public services, charities and others is so big, and the capital available to most of them is so small that they lack the resilience to survive this shock without one of three things happening. One is that they need an increase in income. The second is that they need financial support, and probably of a non-repayable nature because it will be spent on consumption and not investment. Or third, the price rise has to be avoided by state intervention. Any or all of those are possible: I think all three will be required as I reflect in Surviving 2023. And I stress, all need help, and not just households.

But, and it is vital to stress this: this is but a stage, and it will self-correct. The hype in markets caused will diminish: order will be restored and that will be true whether or not war continues, or not. Supply chains will work around this. They are just not there yet.

The second stage of this is recovery. This could happen in late 2023, but is more likely in 2024. The chance of this relatively short-term recovery depends entirely on the actions taken by the government now. If the plan by the government is to support people with all the help that they need with the aim of keeping people and families well, fit, fed, together and in both their homes and jobs then the recovery stage will be relatively quick. All the foundations for a return to normal will be in place if this is the policy.

Unfortunately, this is not the policy. Tory leadership candidates are saying that they cannot help because there is no money (which we all know to be a lie, because they can create it) whilst the Bank of England is seeking to destroy the chance of people affording heat and food and the prospect of staying in their homes by increasing interest rates. Their intention is to crush spending power when it is already shattered. As a consequence, they want to force business closures and unemployment. They also want to create credit, rent and mortgage crises, all based on making debt unaffordable. In other words, their plan is to leave us in the worst possible place for recovery once prices stabilise, which they will despite, but most definitely not because of, the Bank of England’s policies.

Then there is the longer term. This is where we face the structural problems. We are too dependent on gas. We need a Green New Deal to transform energy usage and deliver climate goals. We need to create high-paying work. This requires investment. After the shocks it has faced business will not do this. Only the government can. But as far as the Bank of England is concerned its job at this time will be to suck funds out of the economy through quantitative tightening (QT), which reverses QE, when what it is highly likely that we will need is QE or other forms of Bank of England support to fund transformation.

In other words, big thinking is required. And we are not getting it. Instead, we heard demands all day on August 17 for higher interest rates and for the imposition of pain that commentators claim is necessary to deliver the austerity that they think is needed to rid us of inflation. They’re wrong: inflation is already going, but not at the consumer level, as yet. What is required is not pain, but help to get through this. A great deal depends on politicians understanding that this is the case, and it seems that very few do as yet.

For more from Richard, please visit his blog.