Three baseless taboos are derailing national renewal – but they need not

The question is not whether the UK needs a decade of national renewal as Sir Keir Starmer claimed. We can see the need in nearly every city in the UK. Shops close and are boarded up; and when they reopen, it is often as charity shops or betting shops. School buildings need repair, and universities are closing departments. Almost one in three children are growing up in poverty. The homeless are on the streets in growing numbers and the UK now has more foodbanks than branches of McDonalds. Our roads are riddled with potholes and our rivers flow with faeces. The need is visible everywhere.

The question is: are we going to see that promised national renewal?

The bad news is that while commentators and policy makers remain in thrall to three taboos, a fallacious but remorseless ‘logic’ will make national renewal impossible – indeed the taboos lead to perverse decision-making which reinforces growing inequality and poor economic growth overall.

The good news is that, as soon as we reject the taboos, we can start to rebuild our economy and our society.

The three taboos

A taboo is a superstition: driven by custom or emotion rather than facts or evidence.

In Polynesia, in some societies, if a commoner touched the Chief’s shadow, only that person’s death could compensate for the breaking of the taboo. This seems extraordinary to us today.

But strangely, we do not find it extraordinary when respected organisations and individuals tell us that government debt is now at dangerous levels and we cannot safely borrow more, that taxing the wealthy would be counter-productive and would prevent their wealth-generating investments which enrich us all, or that creating money would inevitably lead to some form of hyper-inflation.

And yet all of these are just as baseless as the idea that one should not touch a Chief’s shadow.

In fact, our debt is not dangerously high, and it is not in danger of spiralling out of control, unless government policies are consistently so bad that our growth rate will be below our cost of borrowing (a cost which is entirely under the government’s control). Although it seems widely accepted by many people who should know better, debt hysteria has no basis in fact. It is however extremely dangerous as a basis for policy-making.

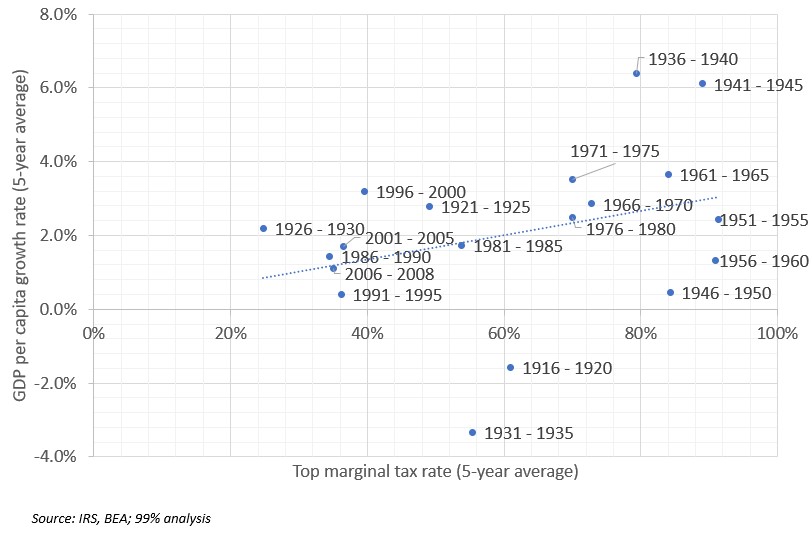

The idea that taxing the wealthy would inevitably damage the economy and hurt the poorest also bears no relation to reality. We have all seen how poorly the trickle-down effect has worked over the last 40 years both in generating growth and in sharing it fairly.

Here is the picture for growth.

And here is how the proceeds of that growth have been shared.

Economic performance started to dip, just as the Top 1% started to grow their share of national wealth.

And to those who argue that “no country has ever taxed its way to prosperity,” the USA stands as a shining counter-example.

And in fact, most other developed countries do, too.

Finally, the idea that money creation inevitably leads to hyperinflation (or even high inflation) flies in the face of our lived experience. Since 2009, the UK government has, via the Bank of England, created no less than £895 billion, but we did not experience high inflation until Putin invaded Ukraine, and energy prices (globally) rose significantly.

So there is no reason why we should accept any, let alone all, of the taboos.

But what if we do accept them all?

National helplessness

If we accept all three, then we have to conclude that the government cannot borrow for renewal, it cannot tax for renewal and it cannot create money for renewal. It must run as if it were a household. Economists know that it is a fallacy that governments should run like households – but not, it seems, most commentators or policy-makers.

We debunked that fallacy in this earlier article, summarised in the picture below.

But if we accept the fallacy, we must conclude that the government is powerless to invest in national renewal, and we must instead rely on the ‘magic of market forces’ to generate the economic recovery we need.

That this is the policy that has failed for the last 40 years does not matter – if we accept the taboos, there is really no alternative.

Perverse decisions

And that leads to truly astonishing decision-making.

We hear politicians say that they are “not afraid to take hard decisions.” In reality, they are afraid to challenge the taboos – very afraid – so instead they penalise the very people they were elected to help. They reduce benefits to the poorest and most vulnerable, they underfund our public services, and they allow schools and universities to close.

What CEO would look at the last 40 years of declining GDP growth and believe the Chancellor who tells them that ‘this time, we have a plan for growth’? And if they cannot believe it, what do they do when the government asks them what they need for growth? – they tell the government what they need to increase profits. And that is deregulation and tax cuts. What is surprising is that politicians continue to believe that these things will lead to growth. The UK government is even considering unwinding the regulations that were introduced to prevent Britain being so damaged in the next Global Financial Crisis: as the Bank of England points out, this would merely increase the riskiness of our banks.

It requires a strong belief in magic to think that national renewal can be delivered without breaking the taboos.

But is it safe to break them?

Lifting the taboos

The UK government is in a difficult position. Significantly more difficult than the position facing Blair and Brown in 1997. But not as difficult as in 1946. After the Second World War, our debt:GDP stood at around 250%, roughly half of GDP had been diverted to the war effort – we were making things that nobody wanted any more. We had lost around one million people. And our infrastructure was in worse shape than today.

National renewal was a priority then as now. And if Attlee had been constrained by the taboos which beset Starmer and Reeves, he could not have prevented mass unemployment as the troops were demobilised, and he could not have implemented the Beveridge Plan. Neither the NHS nor the Welfare State would exist. Generations of Britons would have had shorter, poorer lives.

Thankfully, Attlee listened to Keynes who said, “Anything we can actually do, we can afford.” And he ushered in the most successful period in the UK’s economic history.

More recently, when the Global Financial Crisis (GFC) struck, the government changed its fiscal rules to enable the Bank of England to bail out the banks – suddenly, £375 billion extra money was created to prevent economic collapse. But then the taboos were re-established, and we had austerity from 2010.

Not every country implemented austerity: the Chinese response to the GFC can be summarised as “We are aware that there will be a global recession; we have decided not to take part.” And China’s subsequent performance is testament to the wisdom of that approach.

In 2015, the Portuguese government decided to lift the taboos – and its performance since has been transformed.

When governments are determined and courageous, they find a way. But they do need courage to lift the taboos.

If you think more people should be aware of the damage the three taboos are doing to the fabric of our nation, please share this article.

And take a look at the 99% organisation and join us.