As the Office for National Statistics has noted on 19 April 2023:

- The Consumer Prices Index (CPI) rose by 10.1 per cent in the 12 months to March 2023, down from 10.4 per cent in February.

- On a monthly basis, CPI rose by 0.8 per cent in March 2023, compared with a rise of 1.1 per cent in March 2022.

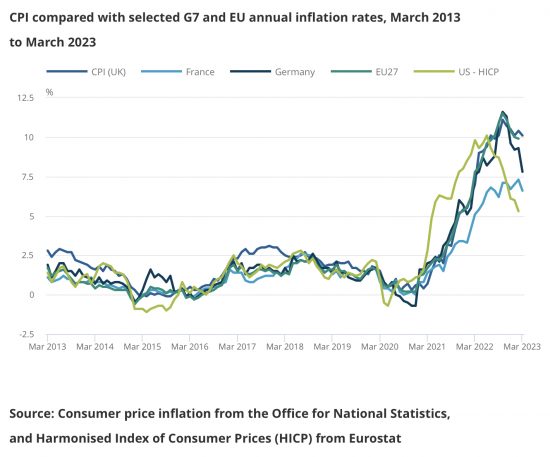

That is disappointing. This small decline contrasts markedly with experience in Europe:

Rates are tumbling in the way I would expect in France (a bit) and Germany, especially. Why aren’t they here? The answer appears to be in the rigidity of our energy pricing, and Brexit (of course).

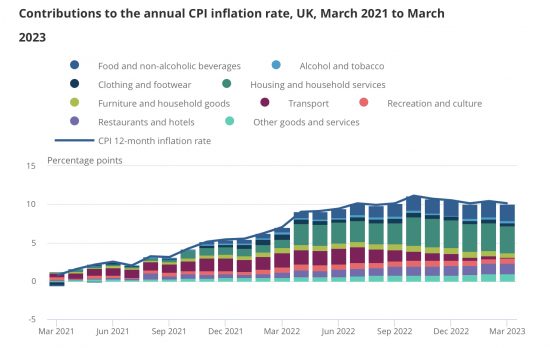

Dealing with energy pricing first, this chart gives some indication of its significance:

The large green band is household costs and by far the largest increase in that is energy costs. Since the rigidity is our rigged markets will not let these fall yet we will suffer higher inflation for much longer than Europe. The message is very clear: we need to change energy price regulation.

The other large component, in blue, at the top, is food. This is not entirely down to Brexit, but if we are looking for differences with the European experience, it most definitely is.

None of this changes my argument that inflation will tumble this year. Energy price caps are going to be much lower in the second half of the year. Inflation will fall then.

Nothing also in this data does anything to change the argument that this inflation is all about some companies exploiting inflation for gain. It is not wages driving inflation: they are lagging far behind it. Profits are what are keeping us worse off. Profit taking and the dogmatic refusal of our politicians to address the disaster that is Brexit are what are keeping UK inflation higher than it should be.